Facts About Pvm Accounting Uncovered

5 Simple Techniques For Pvm Accounting

Table of ContentsSome Known Details About Pvm Accounting 5 Simple Techniques For Pvm AccountingThe Buzz on Pvm AccountingA Biased View of Pvm AccountingThe Of Pvm AccountingThe 5-Second Trick For Pvm Accounting

Manage and manage the production and authorization of all project-related billings to clients to foster excellent communication and stay clear of problems. financial reports. Ensure that appropriate reports and paperwork are submitted to and are updated with the internal revenue service. Make certain that the audit procedure adheres to the law. Apply needed building and construction bookkeeping criteria and procedures to the recording and coverage of construction task.Communicate with numerous funding firms (i.e. Title Firm, Escrow Business) concerning the pay application procedure and requirements needed for settlement. Aid with applying and maintaining inner monetary controls and procedures.

The above declarations are intended to define the general nature and level of work being executed by individuals designated to this category. They are not to be understood as an extensive list of responsibilities, tasks, and abilities required. Personnel may be needed to do obligations beyond their normal responsibilities every now and then, as needed.

Things about Pvm Accounting

Accel is looking for a Construction Accounting professional for the Chicago Workplace. The Building Accounting professional executes a selection of accountancy, insurance policy conformity, and task administration.

Principal tasks include, but are not limited to, dealing with all accounting features of the firm in a timely and precise fashion and giving reports and schedules to the firm's CPA Company in the prep work of all economic declarations. Makes sure that all accountancy treatments and functions are managed precisely. Accountable for all economic records, pay-roll, financial and daily operation of the bookkeeping feature.

Prepares bi-weekly trial balance records. Works with Task Supervisors to prepare and publish all month-to-month invoices. Processes and issues all accounts payable and subcontractor settlements. Produces monthly recaps for Workers Settlement and General Responsibility insurance policy premiums. Produces monthly Work Price to Date records and dealing with PMs to integrate with Project Supervisors' spending plans for each task.

Pvm Accounting Can Be Fun For Everyone

Effectiveness in Sage 300 Building and Realty (formerly Sage Timberline Workplace) and Procore building and construction administration software a plus. https://www.blogtalkradio.com/leonelcenteno. Should additionally excel in other computer software systems for the preparation of reports, spread sheets and other accountancy analysis that might be required by management. Clean-up accounting. Should have strong business abilities discover this and capacity to focus on

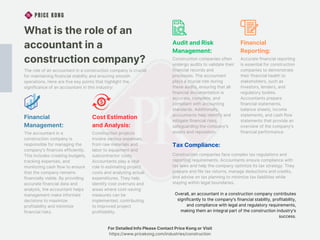

They are the monetary custodians who make sure that construction jobs stay on spending plan, follow tax obligation policies, and preserve monetary openness. Building accountants are not simply number crunchers; they are tactical partners in the building procedure. Their primary duty is to handle the economic facets of building and construction jobs, making certain that sources are alloted efficiently and financial risks are reduced.

Pvm Accounting Can Be Fun For Everyone

They function carefully with job supervisors to develop and keep track of budgets, track costs, and forecast economic requirements. By preserving a limited grasp on job funds, accountants assist stop overspending and economic obstacles. Budgeting is a keystone of successful construction projects, and building accounting professionals are critical hereof. They produce thorough budget plans that incorporate all project costs, from materials and labor to licenses and insurance policy.

Browsing the facility internet of tax guidelines in the building and construction sector can be tough. Building and construction accounting professionals are fluent in these regulations and guarantee that the project abides with all tax needs. This consists of managing pay-roll tax obligations, sales tax obligations, and any type of various other tax responsibilities particular to construction. To excel in the function of a building accountant, individuals need a strong academic structure in bookkeeping and finance.

Furthermore, qualifications such as Qualified Public Accountant (CPA) or Licensed Building Industry Financial Expert (CCIFP) are highly regarded in the sector. Building and construction jobs frequently include tight target dates, transforming regulations, and unforeseen expenses.

A Biased View of Pvm Accounting

Specialist accreditations like CPA or CCIFP are also very advised to show experience in construction bookkeeping. Ans: Construction accounting professionals develop and check budget plans, identifying cost-saving possibilities and making sure that the project remains within budget. They also track costs and forecast monetary needs to stop overspending. Ans: Yes, building accounting professionals handle tax obligation compliance for building tasks.

Introduction to Building Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction companies need to make tough options among lots of economic choices, like bidding on one job over one more, selecting financing for materials or equipment, or establishing a project's profit margin. Building and construction is an infamously unstable market with a high failing rate, slow time to repayment, and inconsistent cash money flow.

Manufacturing includes repeated procedures with quickly recognizable costs. Manufacturing calls for different processes, products, and devices with varying prices. Each job takes place in a brand-new place with varying website conditions and one-of-a-kind challenges.

Everything about Pvm Accounting

Durable relationships with suppliers alleviate settlements and enhance performance. Inconsistent. Constant use various specialized service providers and providers impacts effectiveness and cash money circulation. No retainage. Payment arrives in full or with regular repayments for the complete contract amount. Retainage. Some part of settlement may be withheld until job completion even when the contractor's work is completed.

While traditional producers have the advantage of regulated settings and optimized production processes, building firms need to continuously adapt to each new project. Also somewhat repeatable projects require alterations due to site conditions and various other variables.